Understanding the Blue Cross Blue Shield Settlement: What You Need to Know

The Blue Cross Blue Shield settlement represents a significant development in healthcare litigation, potentially impacting millions of individuals and businesses across the United States. This legal resolution addresses allegations of anticompetitive practices within the Blue Cross Blue Shield Association (BCBSA) and its member companies. This article aims to provide a comprehensive overview of the settlement, explaining its key provisions, who is eligible for compensation, and how to navigate the claims process.

The Blue Cross Blue Shield settlement is designed to compensate those who were allegedly harmed by the BCBSA’s business practices. Understanding the nuances of this settlement is crucial for determining whether you are entitled to a portion of the funds and ensuring you take the necessary steps to file a claim. This guide will delve into the details of the lawsuit, the specific allegations, and the terms of the agreement reached.

Background of the Blue Cross Blue Shield Lawsuit

The lawsuit against Blue Cross Blue Shield stemmed from accusations that the association and its member companies conspired to limit competition in the health insurance market. Plaintiffs argued that the BCBSA’s restrictive licensing agreements and territorial limitations prevented individual Blue Cross and Blue Shield companies from competing with each other, ultimately leading to higher prices and reduced choices for consumers and employers. These agreements essentially divided the market, granting each Blue Cross Blue Shield entity exclusive rights within its designated geographic area.

The core of the argument revolved around the concept of market allocation, which is generally considered an anticompetitive practice under antitrust laws. By restricting competition among its members, the BCBSA allegedly violated these laws and negatively impacted the healthcare landscape. The lawsuit sought to rectify these alleged violations and provide compensation to those affected by the anticompetitive behavior. [See also: Antitrust Law in Healthcare]

Key Provisions of the Settlement Agreement

The Blue Cross Blue Shield settlement agreement includes several key provisions designed to address the alleged anticompetitive practices and provide relief to affected parties. The most significant aspect is the establishment of a settlement fund totaling billions of dollars, which will be distributed to eligible individuals and businesses who purchased Blue Cross or Blue Shield health insurance plans during the class period.

In addition to the monetary relief, the settlement also includes injunctive relief, which aims to prevent similar anticompetitive behavior in the future. This includes changes to the BCBSA’s licensing agreements and rules, allowing for greater competition among its member companies. These changes are intended to foster a more competitive market and ultimately benefit consumers and employers by offering more choices and potentially lower prices. These changes represent a long-term commitment to fair market practices within the Blue Cross Blue Shield system.

Monetary Relief

The monetary relief component of the Blue Cross Blue Shield settlement is the primary focus for many individuals and businesses. The settlement fund is designed to compensate those who paid inflated premiums or experienced reduced benefits due to the alleged anticompetitive practices. The amount of compensation each eligible claimant receives will depend on various factors, including the type of health insurance plan they had, the duration of their coverage, and the specific geographic region in which they resided. The exact distribution formula is complex and will be administered by the settlement administrator.

Injunctive Relief

The injunctive relief aspect of the Blue Cross Blue Shield settlement is geared towards preventing future anticompetitive behavior. This includes revisions to the BCBSA’s licensing agreements, allowing individual Blue Cross and Blue Shield companies to compete more freely with each other. This could lead to increased competition, potentially resulting in lower prices and more innovative health insurance products. The settlement aims to create a more level playing field for competition within the Blue Cross Blue Shield network. [See also: The Future of Health Insurance Competition]

Who is Eligible for Compensation?

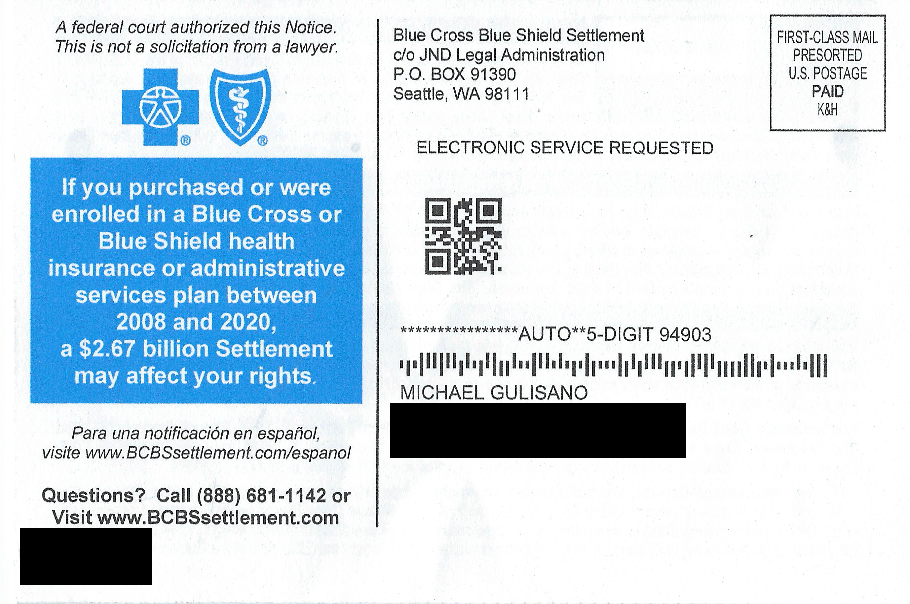

Eligibility for compensation under the Blue Cross Blue Shield settlement is determined by specific criteria established in the settlement agreement. Generally, individuals and businesses who purchased or were covered by Blue Cross or Blue Shield health insurance plans during the relevant class period are eligible to file a claim. The class period typically spans from 2008 to 2020, but specific dates may vary depending on the region and the type of plan. It’s crucial to review the official settlement website or consult with the settlement administrator to confirm your eligibility.

Specifically, the eligible classes include:

- Individuals: Those who purchased individual Blue Cross or Blue Shield health insurance plans.

- Businesses: Employers who purchased Blue Cross or Blue Shield health insurance for their employees.

- Self-Funded Plans: Businesses that had self-funded health plans administered by Blue Cross or Blue Shield.

Certain exclusions may apply, such as individuals or entities that opted out of the class action lawsuit or those who are otherwise excluded by the terms of the settlement agreement. It is important to carefully review the settlement notice and related documents to determine if you meet the eligibility requirements.

How to File a Claim

Filing a claim under the Blue Cross Blue Shield settlement involves several steps. First, you must determine if you are eligible to participate in the settlement. Once you have confirmed your eligibility, you will need to gather the necessary documentation to support your claim. This may include policy documents, premium statements, and other records that demonstrate your coverage under a Blue Cross or Blue Shield health insurance plan during the relevant class period.

Next, you will need to complete and submit a claim form. Claim forms can typically be obtained from the official settlement website or by contacting the settlement administrator. The claim form will require you to provide information about your coverage, the dates of your coverage, and any other relevant details. It is important to complete the claim form accurately and thoroughly, as incomplete or inaccurate information may delay the processing of your claim.

The deadline for filing a claim is crucial. Missing the deadline will result in the denial of your claim. Check the official settlement website for the specific deadline and ensure that you submit your claim form and all required documentation before the cutoff date.

Required Documentation

The specific documentation required to support your claim may vary depending on the type of claim you are filing. However, some common documents that may be required include:

- Policy Documents: Copies of your Blue Cross or Blue Shield health insurance policy documents.

- Premium Statements: Records of premium payments made during the class period.

- Coverage Verification: Documentation that verifies your coverage under a Blue Cross or Blue Shield health insurance plan.

- Employee Records: For businesses, employee records that demonstrate coverage under a Blue Cross or Blue Shield health insurance plan.

It is important to gather as much documentation as possible to support your claim. The more evidence you can provide, the stronger your claim will be. If you are unsure about what documentation is required, consult with the settlement administrator or an attorney.

Potential Impact of the Settlement

The Blue Cross Blue Shield settlement has the potential to significantly impact the healthcare landscape. In addition to providing monetary relief to eligible individuals and businesses, the settlement aims to promote greater competition in the health insurance market. By revising the BCBSA’s licensing agreements and rules, the settlement could lead to lower prices, more choices, and more innovative health insurance products. This could benefit consumers and employers alike. [See also: Health Insurance Market Trends]

The settlement also serves as a reminder of the importance of antitrust enforcement in the healthcare industry. Anticompetitive practices can harm consumers and stifle innovation. By holding the BCBSA accountable for its alleged anticompetitive behavior, the settlement sends a message that such practices will not be tolerated. This could deter other healthcare providers and insurers from engaging in similar behavior in the future. The long-term effects of the settlement are anticipated to foster a more competitive and consumer-friendly healthcare environment.

Staying Informed

Staying informed about the Blue Cross Blue Shield settlement is crucial for ensuring that you receive the compensation you are entitled to. The best way to stay informed is to regularly check the official settlement website. The website will provide updates on the settlement, including information about eligibility, claim filing procedures, and deadlines. You can also sign up for email alerts to receive notifications about important developments in the settlement.

In addition to the official settlement website, you can also consult with an attorney or other qualified professional for guidance. An attorney can help you understand your rights and options under the settlement and can assist you with filing a claim. Additionally, numerous news outlets and consumer advocacy groups provide coverage of the settlement, offering insights and analysis on its implications.

Conclusion

The Blue Cross Blue Shield settlement represents a significant development in the healthcare industry. By understanding the key provisions of the settlement, determining your eligibility, and following the proper claim filing procedures, you can ensure that you receive the compensation you are entitled to. The settlement also serves as a reminder of the importance of competition and antitrust enforcement in the healthcare market. By staying informed and taking proactive steps, you can protect your rights and contribute to a more competitive and consumer-friendly healthcare landscape. The Blue Cross Blue Shield settlement is a complex issue, but with careful research and attention to detail, you can navigate the process successfully and potentially recover compensation for any harm you may have suffered.